Mumbai: The Reserve Bank of India (RBI) has approved the application of Japanese giant Sumitomo Mitsui Banking Corporation (SMBC) to acquire up to 24.99% in Yes Bank.

The RBI has further clarified that SMBC would not be classified as a promoter of the bank.

The banking regulator had conveyed its approval to SMBC on Friday. On May 9, 2025, Yes Bank disclosed to exchanges that existing investors want a strategic secondary stake sale.

ET was first to report May 6 that SMBC was in advanced discussions to acquire a stake in Yes Bank and that it had received verbal assurances from the central bank on being allowed to acquire a majority stake.

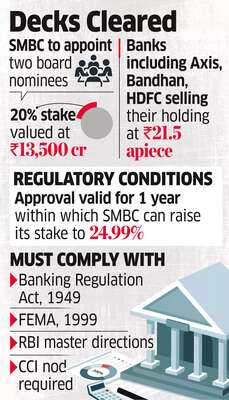

Yes Bank disclosed that SMBC is set to acquire a 20% stake in the private lender - 13.19% from the State Bank of India, and 6.81% collectively from seven other shareholders, including Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, and Kotak Mahindra Bank.

SMBC will appoint two nominees on the board.

The 20% stake sale is valued at around ₹13,500 crore as the banks are selling their stake at ₹21.5 a share.

It does not include the two private equity investors - Advent International and Carlyle.

The bank stated that SMBC has received approval to increase its holding to 24.99%, which is valid for one year, and is subject to compliance with various regulatory frameworks, including the Banking Regulation Act, 1949, Foreign Exchange Management Act, 1999, and RBI's master directions on shareholding in banking companies.

Further, the transaction is subject to clearance from the Competition Commission of India (CCI) and fulfilment of other customary conditions precedent outlined in the original agreements.

The Yes Bank board was superseded in March 2020, and a consortium of lenders bailed it out in a regulatory mandate.

The RBI has further clarified that SMBC would not be classified as a promoter of the bank.

The banking regulator had conveyed its approval to SMBC on Friday. On May 9, 2025, Yes Bank disclosed to exchanges that existing investors want a strategic secondary stake sale.

ET was first to report May 6 that SMBC was in advanced discussions to acquire a stake in Yes Bank and that it had received verbal assurances from the central bank on being allowed to acquire a majority stake.

Yes Bank disclosed that SMBC is set to acquire a 20% stake in the private lender - 13.19% from the State Bank of India, and 6.81% collectively from seven other shareholders, including Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, and Kotak Mahindra Bank.

SMBC will appoint two nominees on the board.

The 20% stake sale is valued at around ₹13,500 crore as the banks are selling their stake at ₹21.5 a share.

It does not include the two private equity investors - Advent International and Carlyle.

The bank stated that SMBC has received approval to increase its holding to 24.99%, which is valid for one year, and is subject to compliance with various regulatory frameworks, including the Banking Regulation Act, 1949, Foreign Exchange Management Act, 1999, and RBI's master directions on shareholding in banking companies.

Further, the transaction is subject to clearance from the Competition Commission of India (CCI) and fulfilment of other customary conditions precedent outlined in the original agreements.

The Yes Bank board was superseded in March 2020, and a consortium of lenders bailed it out in a regulatory mandate.

You may also like

Disabled mum ordered to 'hurry up' as she cried on tarmac of major UK airport

Pakistan Auditor General's latest report highlights mismanagement and expenditure lapses

Horror moment jewellery shop thieves tie up young woman and threaten to kill her

Dabang Delhi K.C. Prepares for PKL 2025: Squad Insights and Match Schedule

Israeli Airstrikes Target Yemen's Capital Sanaa After Houthi Attacks