PhysicsWallah (PW) has refiled its draft IPO papers with the market regulator SEBI, setting the stage for a massive INR 3,820 Cr public listing. With this move, the unicorn is also positioning itself as the first Indian edtech startup ever to list on the Indian bourses.

While BYJU’S was once the flag bearer of the Indian edtech sector, with its plans to list via the special purpose acquisition company (SPAC) route, everyone knows how that went. The Indian decacorn’s lax governance guardrails, knee-deep debt crisis, and all the drama that comes with it is to be blamed.

Unacademy, another edtech beacon that could have borne the Indian edtech flag on the Indian exchanges, is also struggling on multiple fronts — profitability being one of them.

Amid the dilapidated state of the Indian edtech affairs, PW’s attempt to get listed feels like a fresh breeze of optimism for the sector that has been crying hoarse and seeking salvation ever since the funding winter hit Indian startups in 2022.

Now, before we move ahead revealing what the market watchers feel about PW going public, here’s a quick lowdown on its INR 3,280 Cr IPO.

In its DRHP, PW has stated that its IPO will comprise a fresh issue of INR 3,100 Cr and offer for sale (OFS) component of INR 720 Cr. The OFS component will involve share sales by the founders, Alakh Pandey and Prateek Maheshwari, who together own an 80% stake in the unicorn and are expected offload shares worth INR 360 Cr each.

This is unusual in India’s startup IPO market that is filled to the brim with examples of investors taking exits leveraging IPOs. This also suggests that institutional investors have faith in the company and that they are willing to stay invested.

Not to mention, much of the investor confidence in PhysicsWallah is closely tied to Alakh Pandey’s fandom among Indian students. Since the inception of PW in 2016, Pandey has built an image of reliability, directly engaging with students and understanding their academic and financial pain points, an approach that has translated into both loyalty and scale.

While on the operational front, cofounder Prateek Maheshwari has been instrumental in the business strategy, the startup’s core trust continues to hinge on Pandey’s shoulders.

But is the founder’s charisma enough to deliver a bumper listing? Maybe not.

Grey Market Signals More Smoke Than FireMarket observers who spoke with Inc42 are of the view that while a strong brand name alone cannot promise a scintillating public listing, the edtech’s financial health in an already-ailing sector could make for a strong case.

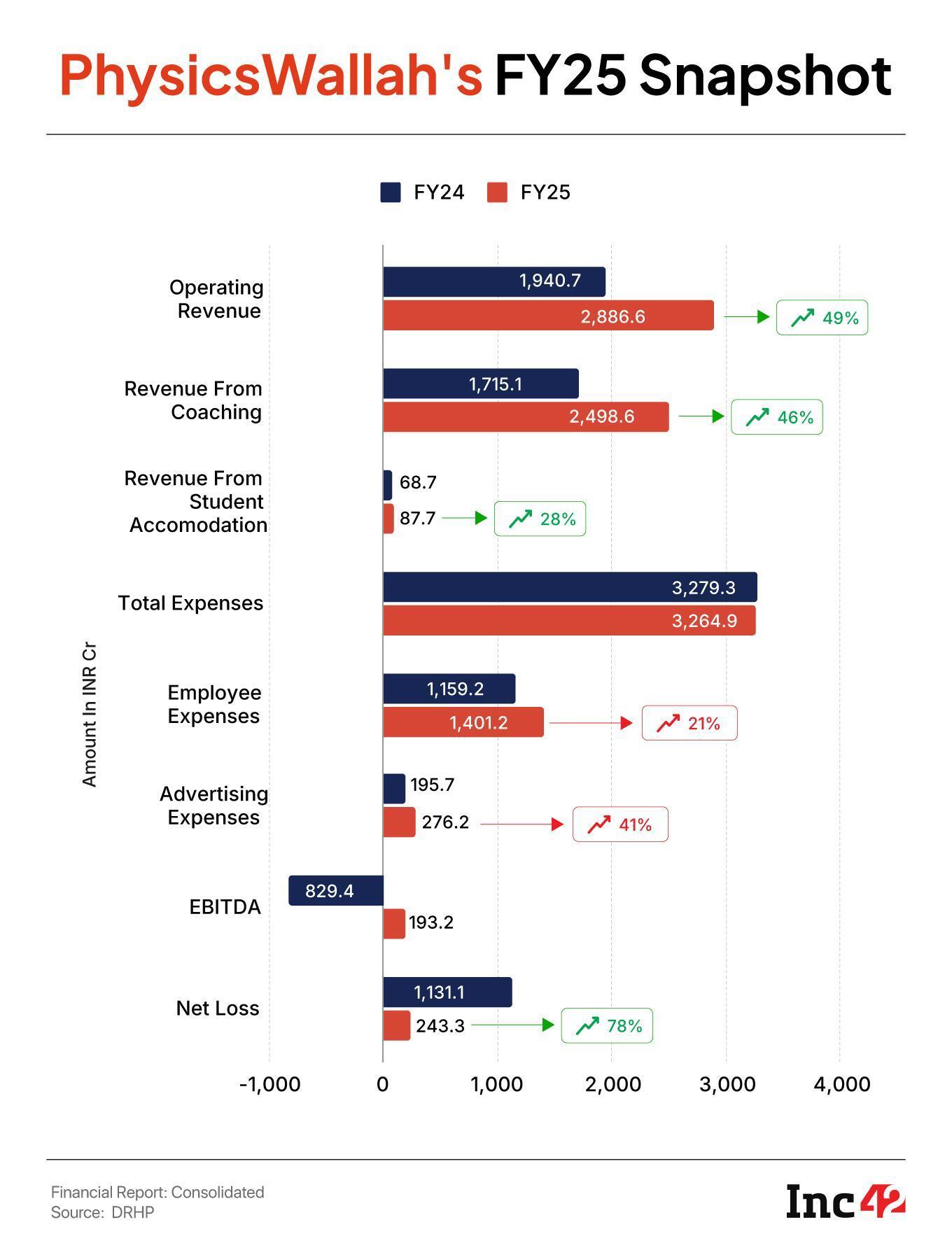

The startup’s loss fell 78% to INR 243.3 Cr in the financial year 2024-25 (FY25) from INR 1,131.1 Cr a year ago, and its revenues surged 49% to INR 2,886.6 Cr from INR 1,940.7 Cr in FY24. Moreover, paid users increased by 22% YoY to 4.46 Mn, as per the updated DRHP.

Domestic operations contributed the bulk at INR 2,851.2 Cr, while its international business grew by 61% YoY, adding INR 35.5 Cr to the edtech’s coffers.

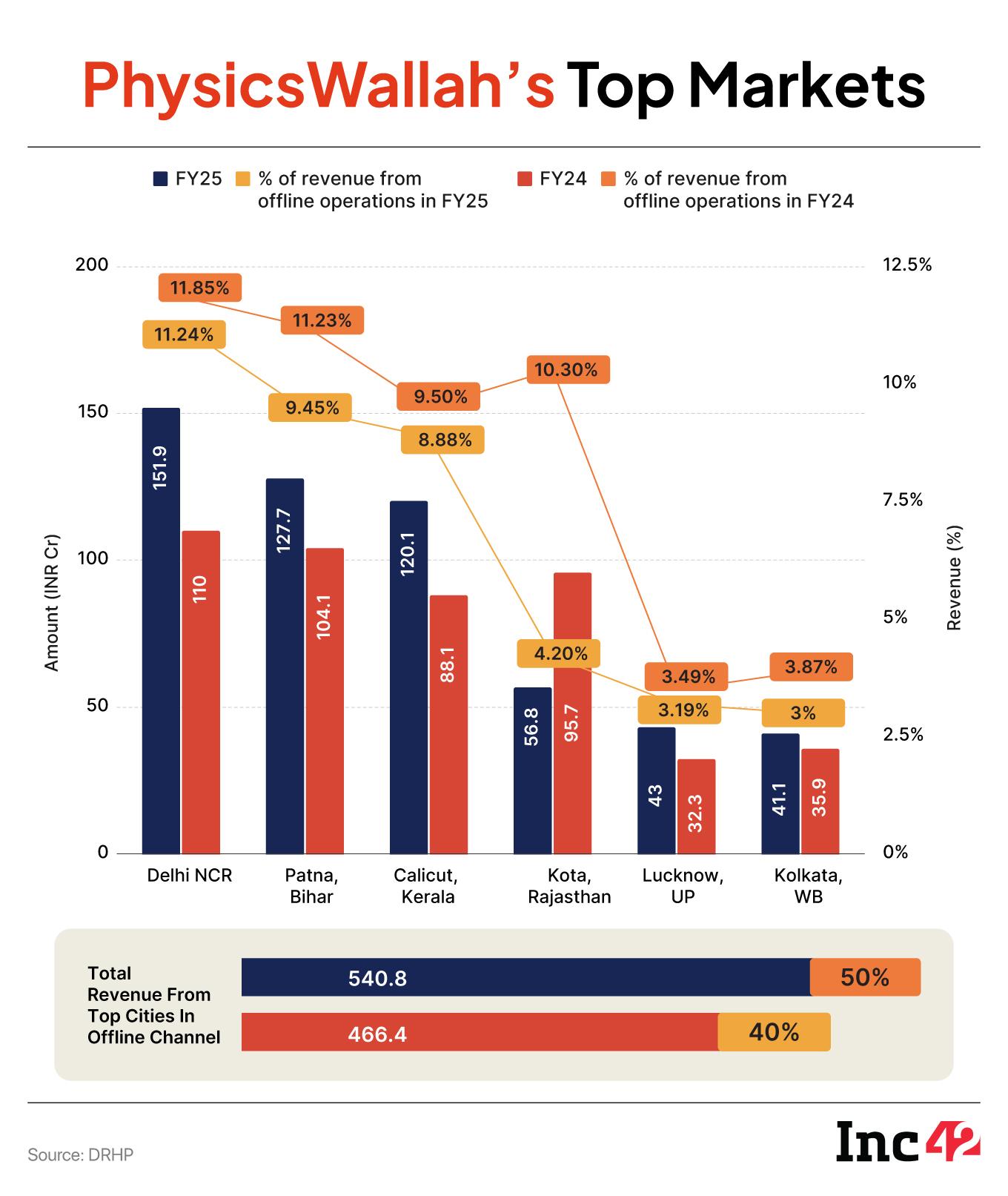

A key driver that spurred PW’s growth has been the shift from an online-first to a hybrid learning model. Since 2022, PhysicsWallah has doubled down on physical coaching centres, targeting cities where its online students were concentrated. This offline push has not only diversified revenue streams with a larger ticket size but also positioned the startup directly against established players in the test prep ecosystem.

“However, beyond fundamentals, the success of PhysicsWallah’s IPO will be heavily sentiment-driven,” a sectoral expert said. Not wanting to appear as an endorser, the expert requested anonymity.

Of course, as the first edtech startup that has come this close to getting listed, expectations run amok, but the real question is whether investors will buy into the Indian edtech story yet again?

Well, the grey market seems to be sitting on the fence.

The edtech unicorn’s unlisted shares are currently trading in the range of INR 145-150 in the grey market. In June, the price was a bit better at INR 165.

A stockbroker tracking the space said that there has been little interest from HNIs over the past quarter. He noted that many are fretting and fight shy of burning their fingers due to the troubled edtech legacy that BYJU’S has left behind.

However, Kush Ghodasara, the managing partner of InvestValue, views the PW listing at a healthy premium because it would be the first edtech company to go public. Yet, he is wary of the edtech’s consolidated losses and high advertising spends. In FY25, the startup splurged INR 276.2 Cr on marketing, up 41% from INR 195.6 Cr in FY24.

According to senior market analyst Dinesh Saney, besides PW’s strong revenue growth, the fact that promoters own an 80% stake in the company shows that they have their skin in the game, which is a positive for their IPO, “but a lot still hinges on the price band”.

Valuation is another conundrum.

Early reports suggest that PhysicWallah could target a valuation of $4 Bn, which is about 1.4X of its last private round.

“They should be flexible with their IPO valuation. They should avoid becoming greedy with the price band,” said a founder of a rival edtech startup, adding that the Indian edtech ecosystem is rooting for PhysicsWallah to succeed.

Not So Strong Fundamentals AfterallAnother factor that could dampen investor interest is PW’s shaky numbers. At first glance, PhysicsWallah’s numbers suggest a strong case for a blockbuster IPO, but a closer look reveals several operational and structural challenges.

A key piece of this puzzle is the bottom line. PhysicsWallah’s FY25 losses may look like they dropped 78% to INR 243.3 Cr, but that’s largely on paper. Once FY24 is adjusted for one-time expenses, the real loss stands at INR 376 Cr during the fiscal. The YoY decline in losses incurred is 35%, which, of course, is an improvement but not as dramatic as the headline figure of 78%.

Moving on, in its DRHP, PW has mentioned that its capex will rise as it scales offline operations. This could further weigh down its profitability. For context, the edtech expects to shell out INR 548 Cr over the course of next three years on offline centres.

Beyond cost, another uncertainty looms large — filling offline classrooms. PhysicsWallah’s early success was driven by deep discounts and aggressive pricing, but sustaining it could prove difficult.

Kota stands as an example. PhysicsWallah’s revenue from operations has declined by nearly 40% in its first offline hub, Kota, due to falling enrolments.

Moreover, the startup’s dependence on JEE, NEET, and other foundation courses adds another layer of risk.

While these remain its primary revenue streams, accounting for 50-60% of PW’s total revenue, the startup’s future growth lies in new verticals such as CUET, UPSC, GATE, MBA, CA, and other skill-based courses.

However, the Alakh Pandey effect could fade here. In competitive exams like UPSC or GATE, aspirants often prioritise coaching institutes with a proven record of top ranks, an edge PW has yet to get.

Therefore, PW has earmarked almost 22% of the IPO proceeds for marketing and brand visibility, as per its DRHP.

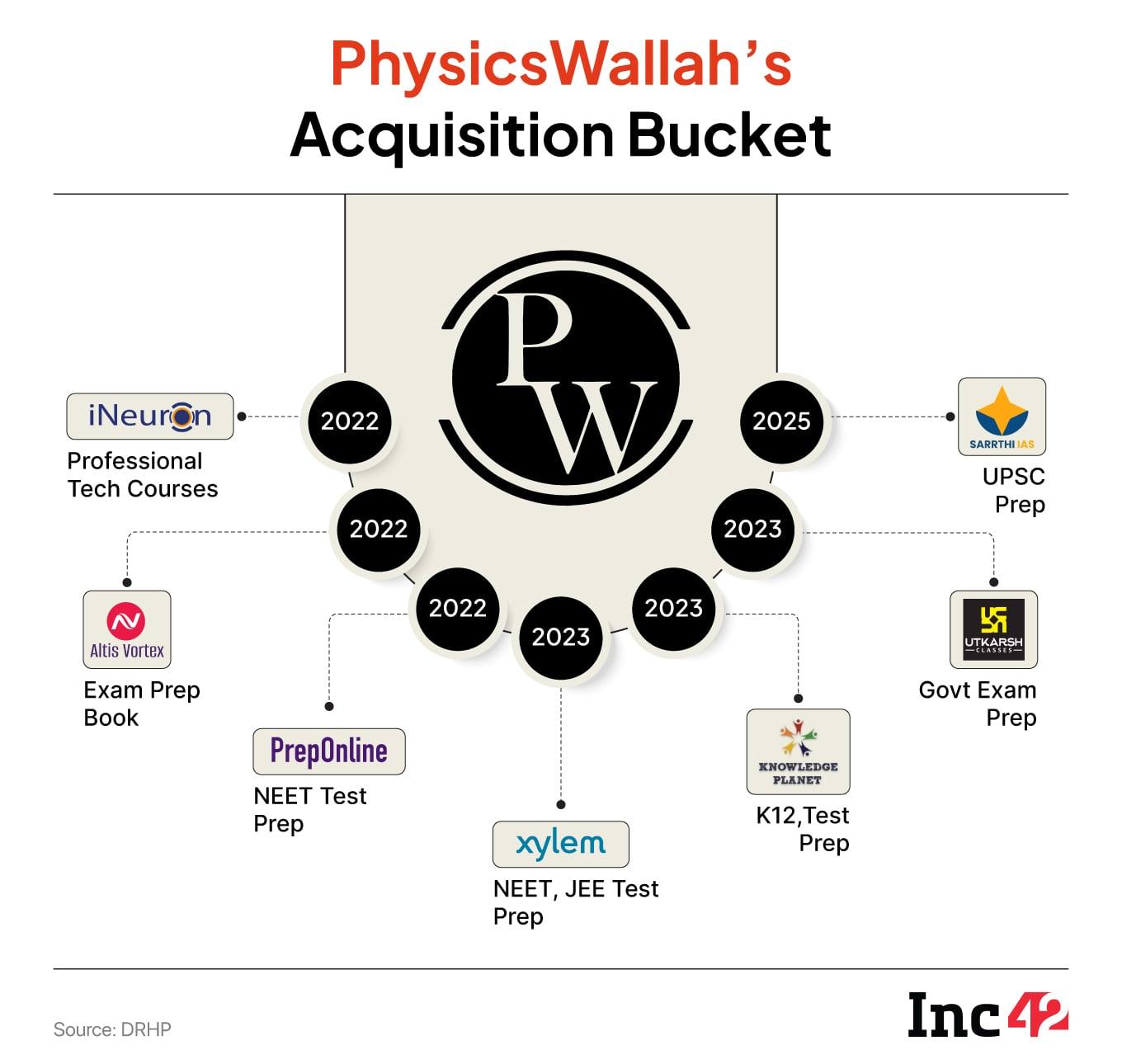

Currently, PW’s total offline student enrolment comprises a meagre 8% of the edtech’s total enrolment. To address the imbalance in offline student intake, PW is acquiring businesses and turning them into a growth lever — a page out of BYJU’S and Unacademy’s playbook.

PhysicsWallah’s buyout journey so far:

- PW first entered the UPSC space in 2023 through OnlyIAS, and later deepened its play with a 40% stake in Saarthi IAS.

- In the government job prep space, PW expanded through acquisitions like PrepOnline, Utkarsh Classes and Altis Vortex, while in the South, it picked up a stake in Xylem to strengthen its regional play.

- For its overseas push, PW acquired UAE-based K-12 online learning platform Knowledge Planet.

- PW wanted to acquire Drishti IAS, but the talks reportedly failed.

Come as it may, market analysts fear that acquisitions come with their own set of challenges. For starters, PW, as a parent, is liable to inherit the financial liabilities of its acquired arms.

Xylem, Kowledge Planet and Utkarsh Classes together have a combined net loss of around INR 100 Cr. This risk is clearly defined in its DRHP. PW is also wary of the fact that if subsidiaries continue to bleed, the core business will have to provide ongoing support, which could strain its consolidated cash flows and erode operating margins.

The next acquisition pangs would be related to integration. The edtech will have to make sure that everything and everyone, ranging from the leadership team to business goals, align with the parent company.

A call to action on who to allow to operate independently or who to absorb under the PW brand name will be another daunting task.

All of this could divert PW’s focus and rupture its core revenue engine — a red flag before its IPO.

However, green shoots, especially emerging from the company’s growing revenues, don’t seem to dismay. While the market is currently enduring a string of lacklustre IPOs, the first edtech listing in India is expected to list with a sparkle. However, what would go a long way in ensuring a bountiful IPO is a reasonable price band, a tab on expenses, a flawless M&A execution and seamless expansion into newer categories. So, the big question is — can PW wipe off the Indian edtech blot with a blockbuster IPO?

Edited By Shishir Parasher

The post Can PhysicsWallah Break The Indian Edtech Jinx With A Blockbuster IPO? appeared first on Inc42 Media.

You may also like

Christine McGuinness makes emotional return to Celebs Go Dating with update - 'I feel free'

Top Gear's James May hit with backlash as he shares gun pic: 'Insanely bad timing!'

Jennifer Lopez sweeps fans away at screening of new movie!

Cops lock circuit house gate to stop AAP MP from holding protest in Srinagar, meeting Farooq

All the Celebs Go Dating stars who found love with non-celebs after epic series finale