Eternal has reported another weak quarter due to stagnation in its core food delivery business and widening losses of its quick commerce platform, Blinkit, amid intensifying competition.

The Deepinder Goyal-led company’s consolidated profits plunged 77.8% YoY to INR 39 Cr in Q4 FY25. For the full fiscal year 2025, Eternal’s PAT jumped 50% YoY to INR 527 Cr while operating revenue zoomed 67% YoY to INR 20,243 Cr.

Here are other key takeaways from Eternal’s Q4 FY25 financials:

- Other income of INR 368 Cr helped Eternal stave off a loss-making quarter

- Blinkit’s top line surged 122% YoY to INR 1,709 Cr but adjusted EBITDA loss soared 4.8X YoY to INR 178 Cr

- Zomato’s adjusted EBITDA stood at INR 428 Cr, up 56% YoY, while adjusted revenue rose 17% YoY to INR 2,409 Cr

- ‘Going Out’ vertical clocked an adjusted EBITDA loss of INR 47 Cr, up 327% YoY, while revenues more than doubled YoY to INR 229 Cr

- B2B supplies business Hyperpure, too, reported a loss of INR 22 Cr while clocking a 93% YoY jump in revenues to INR 1,840 Cr during the quarter

The Blinkit Cash Guzzling Machine: The quick commerce vertical continued to as it added 294 new stores to its kitty in Q4 FY25. The average order value dropped to INR 665 from INR 707 in Q3 FY25. Around 40% of its total store network was “underutilised.”

Slump In Food Delivery Biz Too: Temporary shortage of delivery partners, , cannibalisation by quick food delivery platforms, and sluggish demand weighed heavily on the core food delivery business.

Meanwhile, the company shut down its , due to uncertain profitability prospects.

What’s more? Well, .

From The Editor’s Desk: Armed with four funds, the D2C-focussed VC firm is now looking at a new INR 700 Cr fund to back the best performers from its existing portfolio. But, how has Sauce.vc managed to keep up with India’s D2C boom?

: The hospitality major will be setting up in-house kitchens and quick service restaurants at its Townhouse properties. The Ritesh Agarwal-led travel tech giant aims to add 5-10% revenue at the hotel level with this F&B expansion.

: UPI transactions declined by 2.2% to 17.89 Bn in April from 18.30 Bn in the previous month. The payments infrastructure clocked transactions worth INR 23.95 Lakh Cr last month, down 3.3% month-on-month.

: The homegrown SaaS unicorn has put its $700 Mn chip-making plans on hold due to its capital-intensive nature. Meanwhile, the with Israel’s Tower Semiconductor.

: The streaming major will invest over INR 850 Cr in the country over the next two years to support local content creators and media firms. CEO Neal Mohan said YouTube has paid INR 21,000 Cr to Indian creators in the last three years.

: The two have reaffirmed their partnership and called recent reports of a rift between them “inaccurate and misleading.” This comes after reports suggested that NRAI had paused restaurant onboarding on ONDC due to disagreements.

The homegrown electronics manufacturing major has formed a JV with the Taiwan-based manufacturing company to make notebook and desktop PC products. Dixon will have a 60% stake in the JV.

The influencer platform decided to pull the plug on financial advisory services due to SEBI’s crackdown on unregistered financial advisors. Will its strange pivot to the beauty and lifestyle content space pay off?

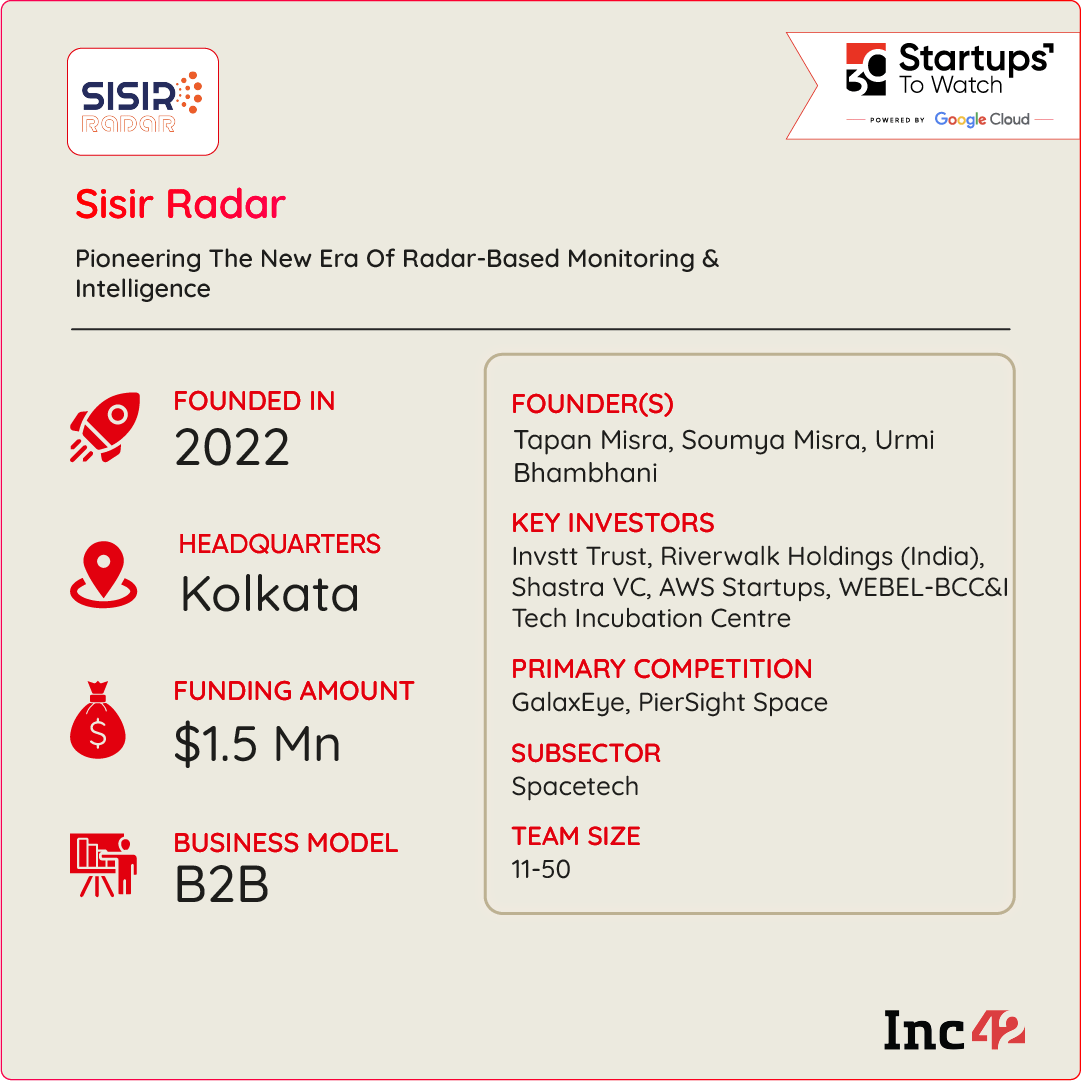

Traditional remote sensing methods often rely on optical sensors, which are limited by weather conditions and the time of day. For industries that need precise and dependable radar systems, these limitations can prove to be a major roadblock.

Sisir’s All-Weather Radar Systems: Sisir Radar has developed a ground penetrating radar (GPR) system that uses radar pulses to create high-resolution 2D and 3D images of subsurface features, useful for everything from infrastructure monitoring to bomb detection. The startup also offers drone-borne hyperspectral imaging solutions by leveraging Synthetic Aperture Radar (SAR) technology.

Real-World Application Of The Tech: The deeptech has use cases for clients in defence, intelligence and commercial applications, enabling 24/7, all-weather earth observation.

Big Opportunity On Sisir’s Radar: Backed by the likes of Shastra VC, Sisir aims to grab a big pie of the Indian radar market, which is projected to become a $1.78 Bn opportunity by 2034.

But with deep-pocketed players like Tata Advanced Systems and Ultra Dimensions on its tail, ?

The post appeared first on .

You may also like

GTA 6 release date delay confirmed as Rockstar apologises for needing extra time

MIKEY SMITH: 12 unhinged Donald Trump moments from the last 24 hours as he gets 'in trouble' with Melania

Saree Styling Tips: The era of matching blouses is over, know which blouse will suit which colour saree?

Chelsea star, 16, back in school to focus on GCSEs just hours after making debut

Keir Starmer to step down? You won't believe who's tipped to replace him as PM