In the aftermath of , an introspection of sorts has dawned upon Indian founders — Why hasn’t the world’s third-largest startup ecosystem cracked the deeptech puzzle yet?

Although forced, this epiphany could pave the way for the initial few bold steps towards making India a deeptech powerhouse. However, the quest is not going to be easy. Why? Let’s discuss at length…

No Defined Definition: The lack of a common understanding of what deeptech means has led to inconsistent narratives and many missed opportunities.

The Talent Chasm: While there is a raging perception that a dearth of talent is holding back India’s deeptech ambitions, studies show that the country is home to some of the biggest AI talent concentration among major economies. But the core problem is brain drain.

No Risk Capital For Deeptechs: Stuck in a vicious loop of long gestation period, heavy capex requirement and translating scientific ingenuity into commercially viable business models, Indian deeptech startups have very few takers in the VC ecosystem.

While the likes of US and China-based AI startups raised a staggering $109.1 Bn and $9.3 Bn in 2024, respectively, Indian AI ventures could manage to scrape a mere $1.16 Bn last year.

The Policy Patch: This is the greatest challenge of all. Founders and VCs want the Centre to ramp up spending on the deeptech sector, engage more with the ecosystem and float contracts for indigenously-built deeptech products. Besides, India does not have foundational AI models or cloud infrastructure of its own, unlike the US or China.

What Needs To Change? Indian founders need to prioritise scientific innovation and long-term R&D over the “shopkeeper” mindset, as Goyal puts it. Then, the government needs to understand that founders and VCs can’t bear this burden alone. Sovereign AI requires sovereign support — serious government funding, risk-sharing, and strategic policymaking.

As the global AI race intensifies and countries like the US and China ramp up efforts in sovereign AI, chips, and quantum tech, India needs to act

From The Editor’s Desk: The Enforcement Directorate conducted raids at several locations linked to OTA EaseMyTrip’s promoter Nishant Pitti as part of its ongoing money laundering investigation into the INR 20,000 Cr Mahadev betting case.

: The drone tech startup secured the capital as part of its Series B round led by Venture Catalysts at a flat post-money valuation of $250 Mn. Meanwhile, the from Cornerstone Ventures.

: The startup found its niche in offering affordable sports nutrition products that are minimally processed and without artificial ingredients. On the back of this, Nutrabay clocked INR 100 Cr in ARR in FY24 and that, too, profitably.

: The Centre is preparing to roll out a new design-linked incentive scheme worth up to $4 Bn to bolster India’s electronics design ecosystem. The scheme will target companies working across 30 semiconductor and 30 electronics product categories.

: The listed house of brands has filed a lawsuit over a Lakme ad, claiming it to be “misleading”. The D2C giant has alleged that the ad campaign, which featured a product resembling a sunscreen from The Derma Co., undermined competitors.

: The hyperlocal logistics startup is in talks with PE firm Wellington Management and others to raise the capital in a mix of primary and secondary sale. The new round is also expected to boost Porter’s valuation to $1.2 Bn to $1.4 Bn.

: The IPO-bound quick commerce major has changed the name of its registered entity from Kiranakart Technologies Private Limited to Zepto Private Limited, following approval from the RoC. Zepto is looking to raise up to $1 Bn via IPO.

: The B2B manufacturing startup has raised the capital in its Series A round led by Capria Ventures. Magma helps factories procure and process raw material, green energy solutions, industrial waste recycling, biomaterials and logistic services.

Inc42 Startup Spotlight Can Kissht Founders Disrupt the Debt Recovery Market?The debt collection process in India continues to be marred by several challenges, be it delayed payments by borrowers, compliance issues, or even difficulties in reaching debtors. On top of this, the need to have an on-ground staff makes the process even more difficult and resource-intensive.

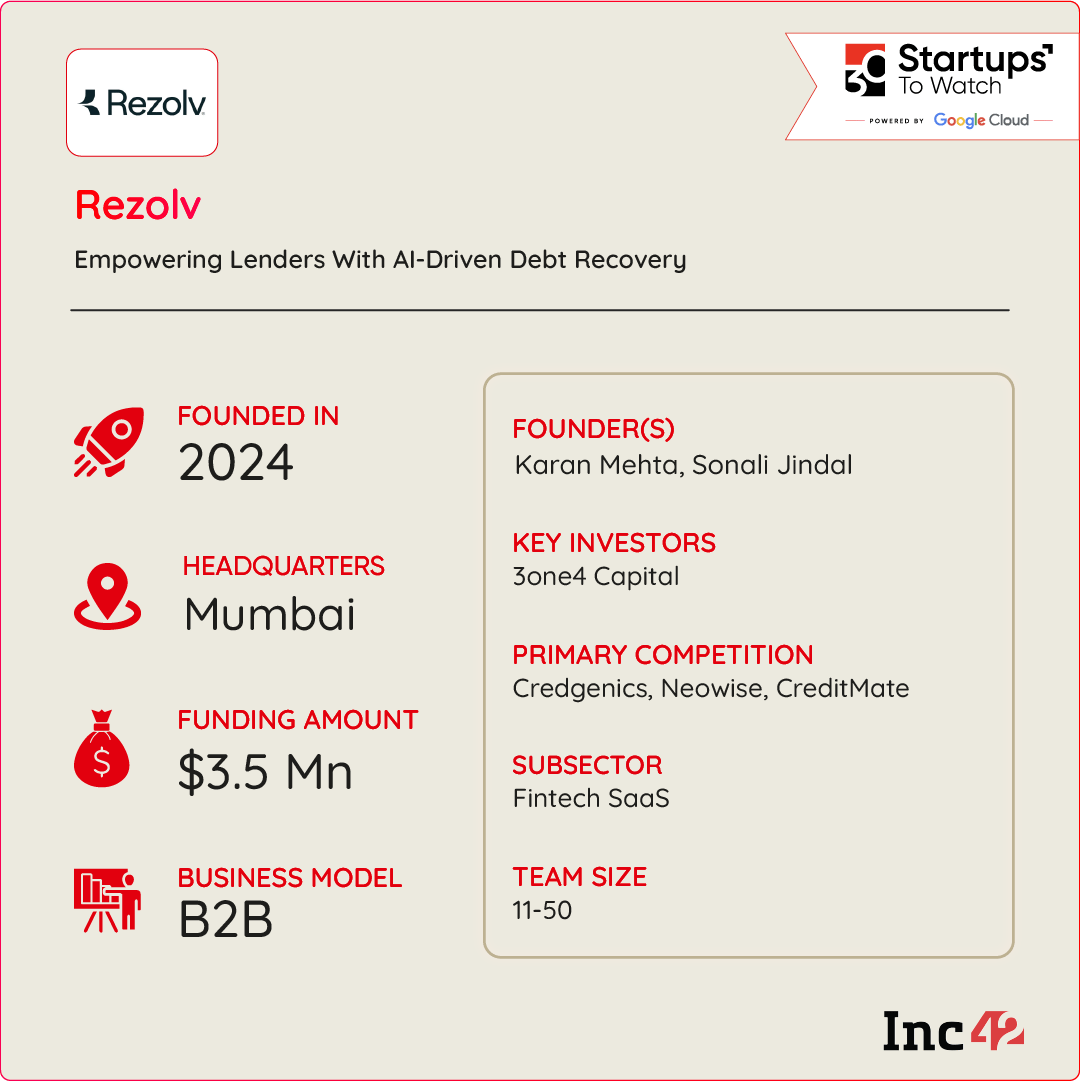

Building On Past Experiences: Having founded lending tech startup Kissht, Karan Mehta and Sonali Jindal first-hand knew the issues ailing debt recovery. Capitalising on their strength, the duo banded once again to float Rezolv in 2024.

Tackling The Pain Points With AI: Rezolv uses AI, GenAI, and advanced analytics to streamline the entire debt collection process, from early delinquencies to write-offs, all within a single platform. Its product suite includes full lifecycle management, multi-product support, and adaptive workforce models, helping lenders improve recovery rates.

What sets Rezolv apart is that it allows lending companies to create custom workflows without relying on IT teams.

How Rezolv Is Turning Heads: Despite launching its operations in January this year, Rezolv has already onboarded two NBFC clients. Going forward, the startup has set its sights on scaling up the platform and expanding its reach.

Operating in an INR 40,000 Cr debt collection market,

The post appeared first on .

You may also like

Morning news wrap: China ready to address trade deficit with India; Hindu leader killed in Bangladesh and more

1st commercial sea shipment of unique Indian pomegranates reaches US: Centre

UK households given £350 warning if they own an electric vehicle

What is the Crucible Curse? Kyren Wilson bids to avoid Ronnie O'Sullivan repeat

'I ditched concealer and foundation for £34 Sephora product that makes skin look glowy'